The shrinking supply of foreclosure inventory appears to be a nationwide trend that is fueling the housing recovery. Low interest rates, motivated investors, and a tight inventory are the major factors contributing to the recovery of the housing market.

Supply of “Shadow” homes declines Again, an article in LATimes.com by Alejandro Lazo explains:

A new report by Santa Ana firm CoreLogic shows pending home supply declined again in October. This shadow inventory fell 12.3% from the year prior to stand at 2.6 million units, or a supply of about seven months.

The housing recovery that began last year was spurred by tight inventory and strong demand from investors and buyers motivated by record-low mortgage-interest rates.

Those factors have helped push up prices in recent months. In a news release announcing the new data, CoreLogic analysts said that given the strong demand from investors, and others, the current shadow supply is unlikely to drag down the market in 2013.

“The size of the shadow inventory continues to shrink from peak levels in terms of numbers of units and the dollars they represent,” CoreLogic Chief Executive Anand Nallathambi said in that release. “We expect a gradual and progressive contraction in the shadow inventory in 2013 as investors continue to snap up foreclosed and REO properties and the broader recovery in housing market fundamentals takes hold.”

CoreLogic estimates the supply of homes that are seriously delinquent, in foreclosure or held by lenders and not currently on the market. Investors and economists keep an eye on shadow inventory to get a sense of how many homes might be headed into foreclosure and hitting the market.

CoreLogic estimated the dollar amount of shadow inventory as $376 billion in October, a decline from $399 billion the same month a year before. Florida, California, Illinois, New York and New Jersey made up about 45% of the shadow supply reported by CoreLogic on Wednesday.”

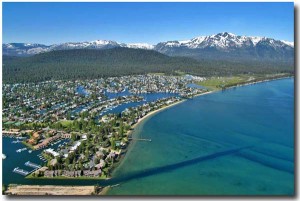

The inventory of foreclosures has steadly declined in South Lake Tahoe as well. There are currently only 16 single family foreclosure listings on the South Lake Tahoe MLS in the city and county areas. Out of the 16 foreclosure listings only 5 are active and the other 11 are in escrow.

Foreclosure Inventory on the South Lake Tahoe MLS:

January 2013

- 16 total foreclosure listings

- 5 active foreclosure listings

- 11 pending foreclosure listings

January 2012

- 57 total foreclosure listings

- 34 foreclosures were active

- 23 foreclosures were in escrow

January 2011

- 62 total foreclosure listings

- 34 foreclosures were active

- 28 foreclosures were in escrow

As Alejandro Lazo said in the article, House hunters looking for bargain properties in the new year will probably be disappointed. It will become very important to have a hard working real estate agent working for you to notify you when good properties come on the market because they may be selling quickly!